This is breaking news 13 years in the making. The National Credit Union Administration (NCUA) has just approved WeDevelopment Federal Credit Union’s application to to be chartered as a credit union.

With next steps, the signing and approval of a Letter of Agreement and Understanding, the credit unions charter should be issued within 30 days and a credit union focused on serving Kansas City’s low- and moderate- income people and communities should be open for business at 3123 – 25 Prospect within an additional 60 days.

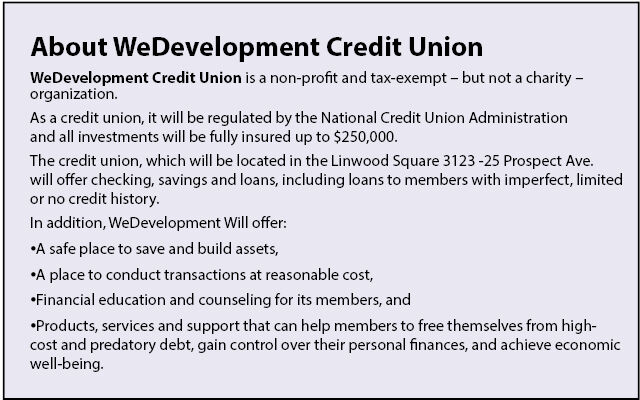

Even for those who don’t know the long history of the proposed WeDevelopment Credit Union, this should be good news. WeDevelopment will be a non-profit Community Development Credit Union (CDCU) that serves populations that typically have limited access to safe financial service. As chartered, the credit union will serve “a contiguous economically distressed area,” with boundaries along the river on the north, to 85th St. on the South, Troost on the west to 435.

Click here to sign up for newsletter

To be a member, individuals will have to live, work or worship in that area. That’s an estimated membership pool of 130,000 people.

The concept for WeDevelopment dates back to 2009, with the idea for the credit union coming out of a task force commissioned by former KCMO Mayor Mark Funkhouser. He formed the commission to find economic development tools that would work at improving “economically distressed areas” of Kansas City. After the task force completed its work, Ajamu Webster, who chaired the task force, and a few other task force members started to work on the reports recommendation to open a CDCU.

BANKING DESERT

There definitely was, then, and still is, a need for a CDCU in Kansas City’s core African-American community, which is classified as a banking desert. You’ve probably heard the term “food desert,” a neighborhood lacking a full-service grocery store that provides healthy and affordable food options.

Similarly, banking deserts are communities with little to no access to mainstream banking services, and like food deserts, they’ve historically and disproportionately existed in lower-income communities and communities of color.

Kansas City, MO’s core African-American community is a banking desert. Instead of mainstream banks, the community is proliferated with check cashing, title loan, and payday loan companies. The lack of banking options is in part a contributor to the disproportionately high percentage of African American in KCMO who are “unbanked,” or not using mainstream banking services.

A 2015 study by the FDIC, found that 12.9% of households in the Kansas City metropolitan area are unbanked. An analysis of this data from the Kansas City Star shows 45% of the city’s African-American households are unbanked.

GETTING THE CHARTER

2010 was a tough time to begin work on a credit union.

“We were just coming out of the subprime lending crisis … banks began to retreat from the community and the void was filed by pay day lending, check cashing and title loan companies,” says Webster. “Folks were getting trapped in that cycle and at that point the support for a credit union became even stronger.”

However, the subprime crisis caused the government to tighten regulations on banks and credit unions. Combined with low interest rates – the main way credit unions earn money – it became harder for the financials to work.

In this historic photo: Rev. Ron LIndsay, Concord Fortress of Hope, and Rev. John Modest Miles, Morning Star Baptist Church in KCMO, celebrate with Ajamu Webster after reaching their $400,000 capital campaign goal for WeDevelopment Credit Union.

The group never gave up. They initially raised $400,000 in capital to fund the bank, but went back and increased that amount to almost $800,000.

The Voice first wrote about WeDevelopment in fall 2018. They were nine years along in their journey and members of the credit unions board of directors had just submitted a revised and updated application to the NCUA. At that time, they Gwen Washington, a seasoned banking professional with nearly 30 years experience, to serve as the banks CEO. Even though at the time the board felt receiving the charter was imminent, Washington spent the past four years helping to guide that organization through the chartering process.

Washington says it takes and average of three to four years to get a credit union charter.

“The application may appear simple, but it’s not,” said Washington. In addition to putting together a strong board and operations team, the financials and projections looking three to five years forward must be sound and the bottom line is sufficient capital. Plus, you’re working with the Federal government, with them, things do always move forward rapidly, continued Washington.

In addition, a few other crises, like a global pandemic and its ensuing financial challenges, also slowed the process.

Overall, Webster says the NCUA remained helpful.

“It’s not like they’re trying to wash us out. It’s not that at all,” said Webster in our 2018 interview. “The requirements are pretty stringent because they don’t want you to fail. They want you to have everything in place to be successful.”

WORKING WITH MEMBERS

Instead of shareholders, credit unions are owned by the members. For that reason, it’s worth the effort for all of the members to help make the business a success.

One of the major goals of WeDevelopment will be to help grow the financial capabilities of its members.

“That’s where credit unions excel,” says Webster. “You don’t go to a bank to rebuild your credit. Credit unions are the place you go to rebuild your credit.”

WeDevelopment hopes to “rebank” some of that large number of people in Kansas City who are identified as unbanked. More than just financial literacy, which Webster says is just handing out information, the credit union will work with people to show them how to rebuild their credit and strengthen their financial capacity. They’ll stay with them through the process, providing feedback on how they’re doing.

Beyond just making it, the credit union will help members look toward investing for their future and looking even further, discuss how do you pass on generational wealth.

“Our mission is to help communities of color create generational wealth,” said Washington.

WORKING WITH THE COMMUNITY

For the credit union to thrive and to be able to help the community, it needs community support. More than the savings account of those with lesser means, the bank also needs deposits from larger organizations who can go anywhere to bank. That doesn’t have to mean bringing all of your deposits to WeDevelopment.

“You can deposit some of your money with us and keep some of your money with your existing bank,” said Washington who made sure to confirm all deposits at the bank are insured up to $250,000.

Washington encouraged churches and small businesses to bring some of their deposits to WeDevelopment. She also asks those organizations to encourage their members and employees to also deposit funds at WeDevelopment.

“We know you can go anywhere, but can you come to WeDevelopment so WeDevelopment can help others in the community.”

When WeDevelopment FCU receives it charter, it will be the first new credit union chartered in the area in 15 to 20 years.